May 21, 2023

We are often asked, “You are investing in which stock market? And how de-dollarization might affect the stock, stock market and the portfolio?

Our primary job is to understand the business, its dynamics and future potential to generate predictable cash flow before we study the stock valuation and its listing.

So rather than stock pickers we are first a business picker and we look to acquire a business which has a well-diversified product-basket, essential services and growing geographies under its umbrella and customers loving their brand, products or services.

We don’t invest in startups; we pick established companies with great operating history and impeccable management track record.

In short we look for companies which are well established in their home market and now expanding around the globe to replicate their success.

If the dollar does lose its status as the global currency we would be protected since growth of these companies are coming from developing and emerging economies and their home market success is evidence of its repeatability in other geographies.

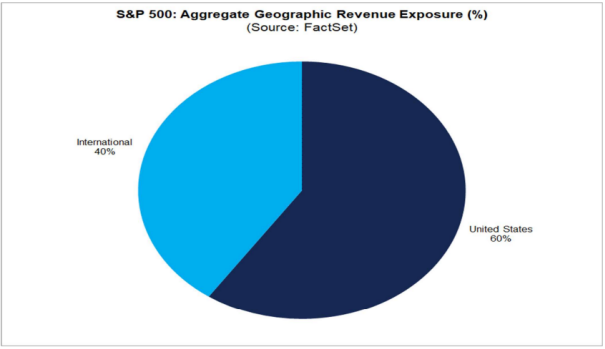

Below graph depicts the revenue breakdown by geography of the S&P 500 companies from developing economies as of March 2023..

A company’s choice of listing in a certain jurisdiction has zero impact in the long term where the underlying business is well diversified; investors must understand in detail about the business of their stock holding by reading the annual report of their portfolio companies.

For the US jurisdiction, the 10-K & 10-Q fillings provide a comprehensive understanding of the company’s business.

Investors exhibit familiarity bias and sound very optimistic about their home market but their views of the US market are often mixed.

While I am optimistic about India being my home country and having strong fundamentals I am not betting against US companies; preference for home country stocks comes from love for the country rather than from the rationale.

As of Q1 2023, the total market capitalization of all the listed companies in the US(NYSE & NASDAQ combined) equals $44 Trillion (1) with the majority of these companies being the biggest investor across the world with one singular aim: to make profits.

Think of Amazon’s entry to the Indian marketplace in 2013, or the more recent thrust by Apple into the Indian market with the opening of their retail outlets in Mumbai and Delhi last month with huge fanfare & the investments made by Facebook and Google in Jio platforms (2) during peak covid period are some of the examples of companies being constantly in search of new lands to increase earnings.

Other examples are unknown fast-growing IT companies like EPAM, and ENDAVA basing their operations in Eastern Europe but generating their revenues in US dollars.

Swedish-headquartered and listed online gaming software company Evolution Gaming is a well-diversified business operating in 9 countries (3) so it would be unfair to categorize it as a Sweden-based stock.

The company has achieved phenomenal revenue growth of 55% in the 8 years it has been listed comfortably taking care of the depreciation of the Swedish Krona from 8.33 to 10.20 during the same period against the US dollar.

Asian Paints which derives close to 100% of its revenue from India is an example of a company listed in the same jurisdiction as its major revenue source.

However, its raw material is sourced from various oil-rich countries including the Middle East.

Even in this case, Asian Paints will adjust its product pricing for the rise in the cost of raw materials.

Asian Paints’ phenomenal returns of 25% CAGR from 2019 to 2023 take care of the Indian rupee devaluation.

If we’ve invested in a great company, with great product, pricing, and strategy (moat) we are well protected against the behavior of its home currency and one should not bother about the geopolitical issues.

Thank you for reading. Feel free to comment, discuss, and questions so we can develop a better investment knowledge base, community, and portfolio.

Gupta

Gupta Copyright 2026. Client First Capital