Fund Performance

The Founder’s Portfolio has been strategized based on the return on investment philosophy of great names like Philip Fisher, Warren Buffet, Peter Lynch, and Raamdeo Agrawal. The mission is simple – To compound your wealth by generating an alpha return, or in other words, a return that is in excess over the popular indices that are used to measure the growth of the market.

There are some tenets that we strictly follow in the identification of potential companies. All our investee companies (or potential multibaggers) must be fundamentally strong and financially stable. Their financials should be of high quality with an ample cash balance and a zero or minimal debt proportion. As regards the growth and profitability aspects, sales growth should be 10% year-on-year for at least 5 out of a period of 10 years. The company should maintain a Return on Equity (ROE) growth of 15%-20% year-on-year. Furthermore, we prefer companies wherein the cash is received in advance prior to the provision of goods/services.

Moving onto the qualitative aspect, the business must be founder driven wherein he / she / they are actively involved in the business operations, and have an in-depth experience in every function, and own a majority stake in the company’s stock. Our strength is to identify great companies over the world with a distinct brand image, and a unique competitive advantage to outpower competitors.

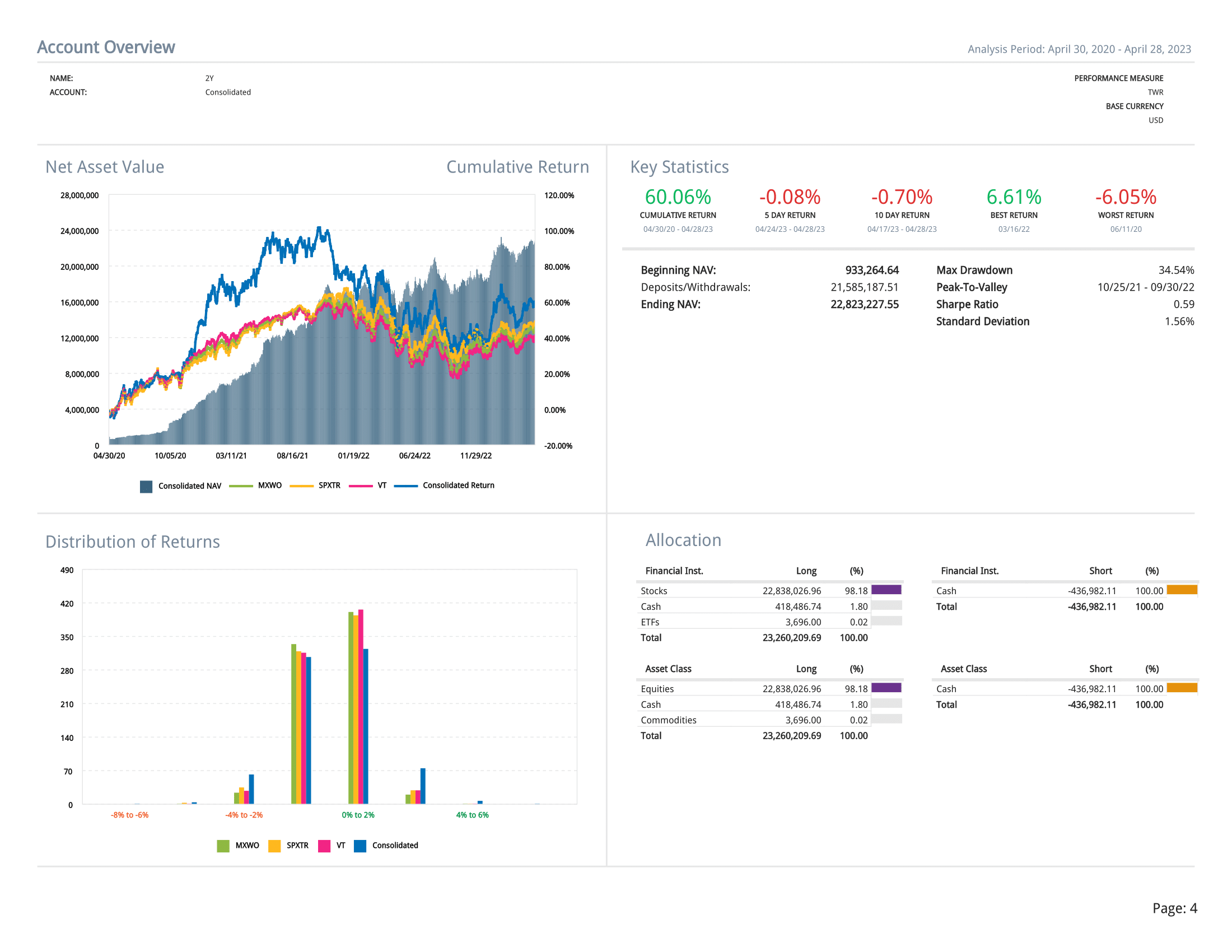

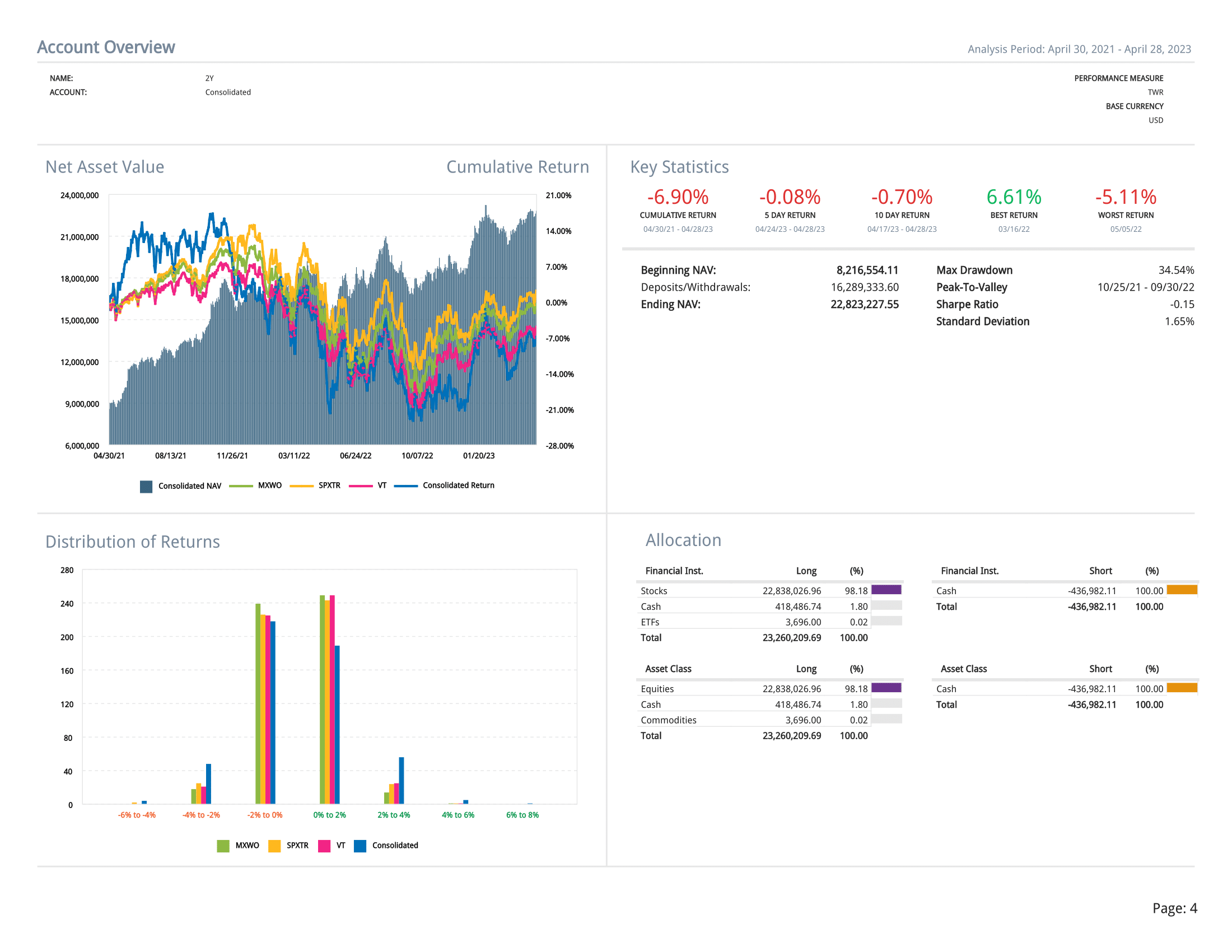

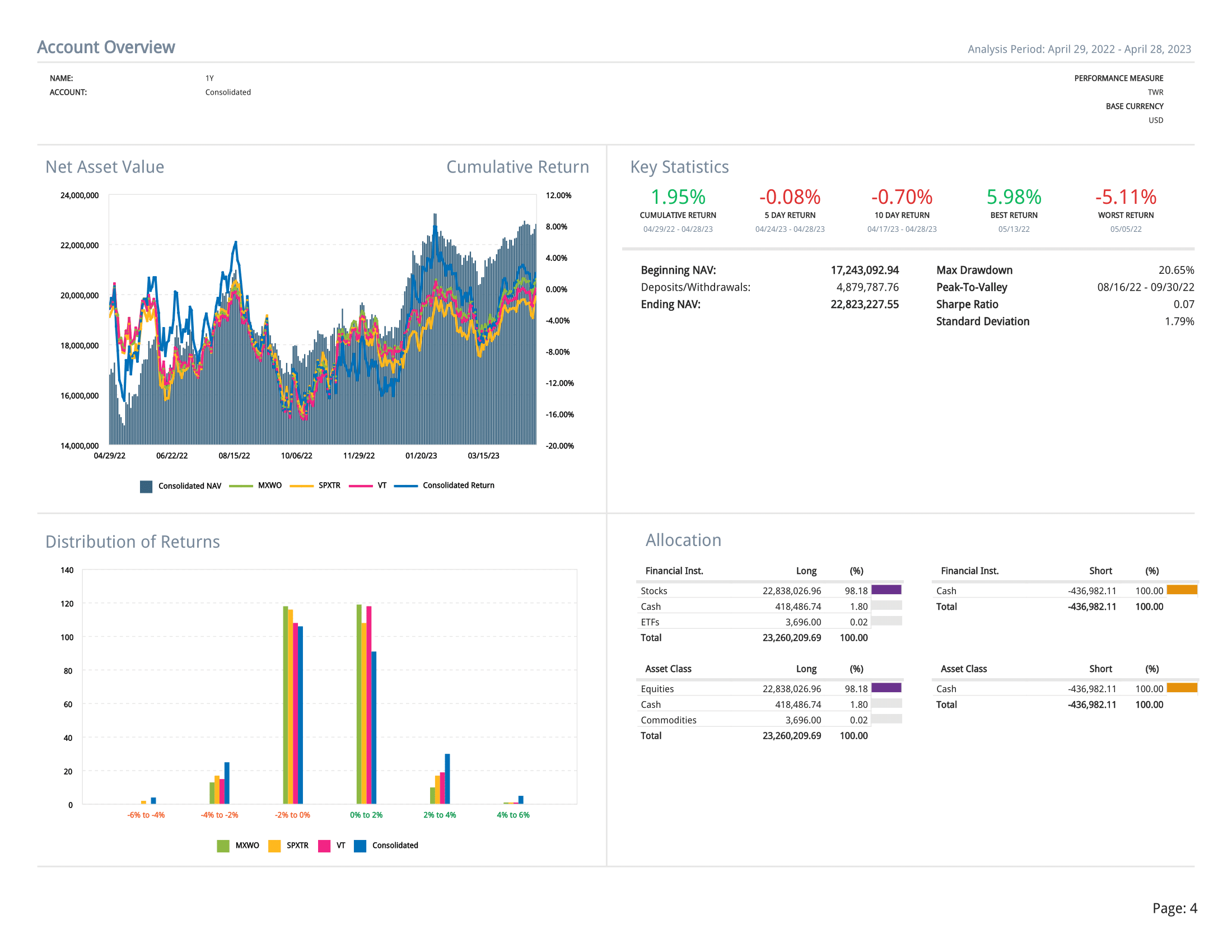

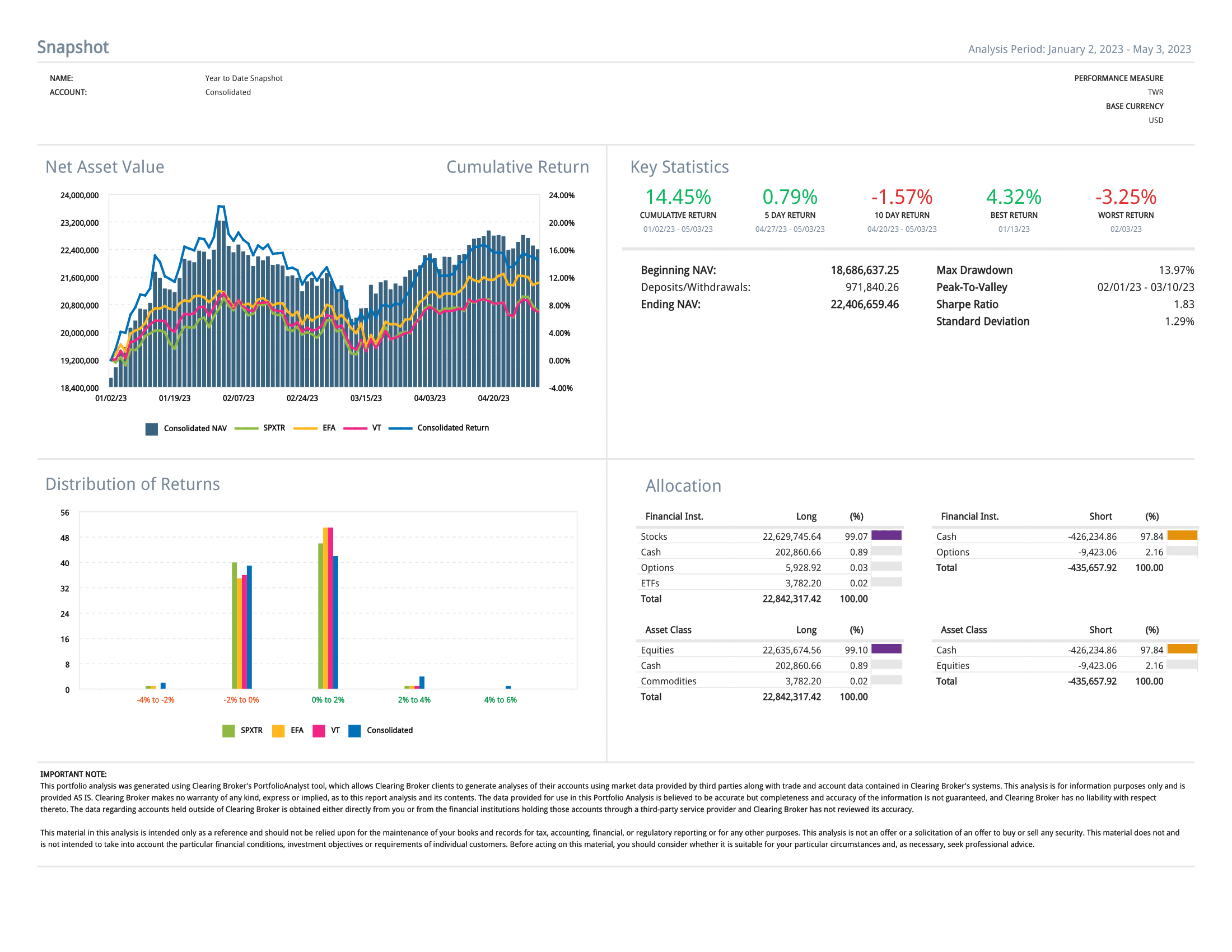

While we do not specifically target the achievement of a specific growth benchmark, the idea is to maximise returns on the portfolio and achieve a high double-digit growth over an extended period. Towards this we constantly monitor the economic indicators, sectoral diversification, company business indicators like the management team, order book, cash flow, and profits etc., apart from looking at the competitive environment and government regulations and interventions. Unlike many other funds that are ring fenced in their strategy through choices in sectors, company size and history, geographies etc., the Founder’s Portfolio is distinguished by its singular aim in achieving investor growth above all else. If need be, we will be happy to relook the composition of the complete portfolio of investee companies to ensure we stay ahead of the game and consistently overhaul popular indices. Case in point, in FY 2020 we outperformed the S&P 500 Index by approximately 16%, the EAFE Index by 22%, and the Vanguard Total World Index by 20% – All this despite the tumult caused by the ongoing pandemic.