Investment Checklist

Our investment checklist is derived from the investment philosophies of Philip Fisher, Warren Buffett, Peter Lynch, and Raamdeo Agrawal.

The Company should have sustained in the business for a minimum time-period of 10 years. There are two major reasons behind the criterion.

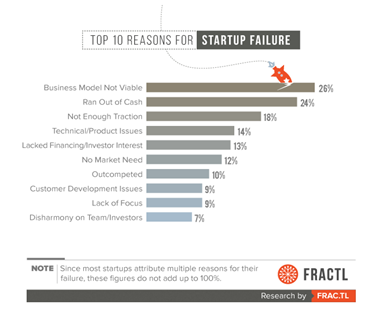

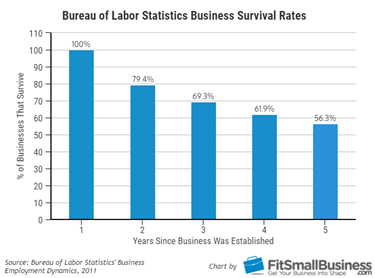

Firstly, “96 Percent of Businesses Fail Within 10 Years”

Secondly, every economy goes through a boom and a recession within a time frame of every 10 years, that in turn impacts a company’s business cycle. As we forecast future performance based on the past performance, we expect that a company that has sustained a past recessionary scenario is likely to do so in the future as well.

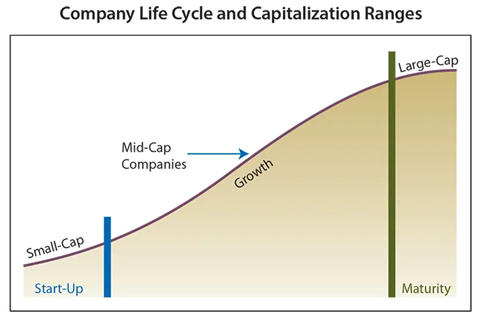

We select future multibaggers with a Market Capitalization between USD 1 Billion – USD 30 Billion (Midcap range). This criterion is based upon our Buy and Hold Investment Philosophy. Our focus is towards identifying Midcap companies with an outstanding growth potential, (potential multibaggers) that are likely to transform into Large Caps of the future, and maintain a disciplined long-term investing approach.

We select future multibaggers with a Market Capitalization between USD 1 Billion – USD 30 Billion (Midcap range). This criterion is based upon our Buy and Hold Investment Philosophy. Our focus is towards identifying Midcap companies with an outstanding growth potential, (potential multibaggers) that are likely to transform into Large Caps of the future, and maintain a disciplined long-term investing approach.

Our mission as a company is to compound/grow investors (aka our client’s) wealth by 5-6 times. Thereby, it is required that the companies in whose stocks we invest grow by 5-6 times as well.

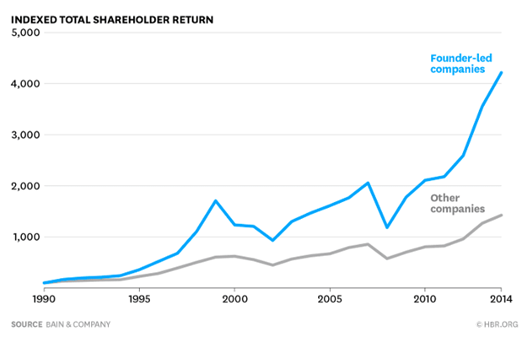

The companies must be Founder/Promoter Driven. One way to depict such an involvement is to analyze the Founder’s stake in the company’s stock. A significant holding of 30%-50% depicts a major skin in the game. As per research, it has been concluded that Founder-led companies have generated significantly higher returns as compared to other companies. Furthermore, we analyze the background of the Founder in terms of education, work experience, track record, etc. The concerned individual must be highly experienced in terms of the business domain, must be aware and imbibe a thorough knowledge of each aspect of the business.

The companies must be Founder/Promoter Driven. One way to depict such an involvement is to analyze the Founder’s stake in the company’s stock. A significant holding of 30%-50% depicts a major skin in the game. As per research, it has been concluded that Founder-led companies have generated significantly higher returns as compared to other companies. Furthermore, we analyze the background of the Founder in terms of education, work experience, track record, etc. The concerned individual must be highly experienced in terms of the business domain, must be aware and imbibe a thorough knowledge of each aspect of the business.

The company must demonstrate a high growth potential in terms of its quantitative drivers. The Sales growth should be 10% YOY for at least 5 years out of a time period of 10 years. Furthermore, the company should maintain a Return on Equity (ROE) growth of 15%-20% YOY. The Return on Equity growth is a significant criteria in our investment checklist as its a major determinant of the Shareholders’ Return.

A low net debt ratio (Debt-Cash) or a reducing level of debt is a significant criterion in our stock selection process. We are most likely to invest into companies with an organic growth potential/cash driven businesses rather than highly levered/debt driven businesses. Usually, companies that acquire a significant level of debt and allocate it towards an inefficient capital expenditure, unplanned business expansion, etc; which in turn do not derive sufficient returns in order to cover costs are most likely to experience a business failure in an uncertain economic scenario such as the Covid 19 pandemic. In order to minimize the risk of loss of our clients’ capital, our focus is towards cash rich businesses with a high quality balance sheet.

In general, a Moat typically means a deep, wide ditch surrounding a castle, filled with water and intended as a defence against attack. Similarly, an ‘Economic Moat’ is a unique competitive advantage such as brand loyalty, patent ownership, barriers to entry, cost advantage, business structure, etc.

Our investment focus is towards companies that display a widening Moat. For example, a certain portion of our portfolio allotment is towards companies that are industry market leaders. A monopoly or duopoly market structure is present in certain capital intensive industries such as shipping, commodities, etc; wherein the barriers to entry are high due to extremely high startup and maintenance costs. As a result, companies need to maintain a certain manufacturing level in order to attain the benefit of economies of scale. Furthermore, an established Brand Image & technological advancements are two factors likely to overcome competition and drive sales in the retail segment.

In today’s growing economy, a vast proportion of brick and mortar businesses have an online presence as well. This has resulted due to lifestyle variations, convenience factor to customers, etc. Furthermore, international expansion potential is higher for online based businesses as they have access to a wide range of customers. Our focus is towards companies with a dynamic business model which in turn facilitates international expansion. The business setup must be stable within the home country and the business model should be designed in a manner such that it can effectively be replicated across the world. To conclude, we invest in traditional brick and mortar companies with an online presence as well.

In today’s growing economy, a vast proportion of brick and mortar businesses have an online presence as well. This has resulted due to lifestyle variations, convenience factor to customers, etc. Furthermore, international expansion potential is higher for online based businesses as they have access to a wide range of customers. Our focus is towards companies with a dynamic business model which in turn facilitates international expansion. The business setup must be stable within the home country and the business model should be designed in a manner such that it can effectively be replicated across the world. To conclude, we invest in traditional brick and mortar companies with an online presence as well.

As per our investment principle, a particular business is classified under one of the following categories:

Great, Good, Gruesome

A great business is cash rich wherein cash from customers is received in advance prior to the physical delivery of goods/services. And in most cases, due to the long lasting relationship with suppliers, such companies may often negotiate credit terms with their suppliers, wherein they would be required to clear the payment within 4-5 months post receipt of the goods/services. Further, the revenue & earnings growth potential is significant, that would potentially compound investors wealth in a similar manner.

A good business has an ability to compound, is identified due to its unique competitive advantage/Economic Moat. But the growth potential or compounding effect is slow as compared to a great business. An investor’s wealth is likely to appreciate in such companies as well.

A gruesome business may raise a significant amount of capital and allocate it towards rapid expansion. The major distinction between a great business versus a gruesome one, is the return on investment generated or business yield as a proportion of the capital expenditure.

In great companies, multifold returns are generated and in turn transformed into cash. Whereas, in gruesome companies, the Return on Investment is often negative wherein organic returns (Business Returns transformed into cash) aren’t generated.

Our investment research procedure is focused towards identifying great and good companies.

The major factors that impact consumer behavior are Product Quality, Product Price and Great Service.

In today’s competitive economy, long term sustainability of a particular business is determined by its ability to establish a distinct brand image and maintain a loyal customer base.

As per our investment checklist, our focus is towards such corporations wherein high quality products are sold at a competitive price, and also backed up by great customer service in terms of delivery, maintenance, etc.

Our valuation approach is based upon Peter Lynch’s ‘Price to Earnings’ (P/E) valuation metric. As per our value investing principle, we focus towards identifying multibagger stocks, wherein the business growth potential is tremendous, but undervalued at present.

Investors are not rational individuals and have numerous behavioral biases that leads to mispricing of a particular stock. Thereby, as part of our research procedure, we determine the fair value of a stock through P/E ratio analysis. We believe that stock price is a slave of a company’s earnings, and as the earnings grow by a certain rate, a similar growth pattern is likely to be reflected in the stock price as well over the long term. Thereby, we invest into companies, wherein the P/E ratio is lower as compared to the long term growth potential of the business, aka Undervalued stocks.

Though a majority of our portfolio allocation is framed based on the above criterion, approximately 20%-30% of the portfolio allocation is towards capital intensive businesses wherein though the debt ratio may be high, the borrowed capital is efficiently utilized and is a value addition to the firm.

Under the Asset Play approach, the focus is towards identifying such companies wherein a hidden asset is present, yet to be tapped. Currently, the balance sheet quality may seem distressed to investors in such a scenario, but once the hidden asset unfolds, significant profits are likely to be generated.

Inflation is a force that disrupts the profitability of various businesses as a result of higher raw material costs, operating costs and so on. Considering the impact, we allocate a certain proportion of our portfolio towards the cyclical sector (Oil & Gas, Shipping, etc) wherein high cost outflows on the production front are balanced out by high revenue inflows on the customer front. Furthermore, as there is a positive correlation between inflation and commodity prices overall, the companies categorized under the cyclical sector can transfer out the burden of high input costs onto their customers. For example, in the shipping industry, inflation results in higher production costs as steel prices are bound to increase. On the other hand, in such a scenario, as there is an increase in containership rates as well, ship manufacturers may enter into customer contracts at higher prices.

The companies must be Founder/Promoter Driven. One way to depict such an involvement is to analyze the Founder’s stake in the company’s stock. A significant holding of 30%-50% depicts a major skin in the game. As per research, it has been concluded that Founder-led companies have generated significantly higher returns as compared to other companies. Furthermore, we analyze the background of the Founder in terms of education, work experience, track record, etc. The concerned individual must be highly experienced in terms of the business domain, must be aware and imbibe a thorough knowledge of each aspect of the business.

“A Founder’s true passion and dedication towards the business is what drives organic growth.”