Being a fund manager, this question never gets old. The frequency of this question multiplies especially with such downward trends being witnessed in the market as we speak. In the quest to make sense of this significant downside, investors theorize based on the headlines that flash before their eyes. The common words doing the rounds include recession, stagflation, hyperinflation etc. In my experience interacting with such investors, all of them end up being perplexed. So much so that they are unable to make any decision despite stocks being available at a bargain. In the meantime, the market takes its own course and investors miss the bus. To avoid being in a state of FOMO, a retail investor always invests at the top hence making less returns in the stock market or has to close down his trading terminal until the next bull market.

Let me take you back to a personal anecdote about the 2008 meltdown. A naive investor and a full time software engineer, like every other IT professional our key responsibility attribute (KRA) was to punt in the stock market, just joking. I remember buying Cineline India (CINELINE) stock for ₹166 in 2007 and holding on to it till today when it is barely touching my cost price.

I submit, at the time I had no clue when to buy or when to sell stocks. Having no study of the financials and the stock market, I did not buy more of the company at ₹35 in 2009 nor at ₹7 in 2012.

It saddens me to see that many of today’s investors are displaying the same behaviour I did 10 years ago. In this article I suggest a couple of pointers to look for in order to have a clear line of thinking amidst all the noise. I would be taking the following companies: Zoom (ZM), Amazon (AMZN), Ollie Bargain Outlet (OLLI) & Geely Automobile (HK.0175) to illustrate the hacks.

How do we know that this is the time to buy more of our portfolio stocks?

“Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”- Peter Lynch

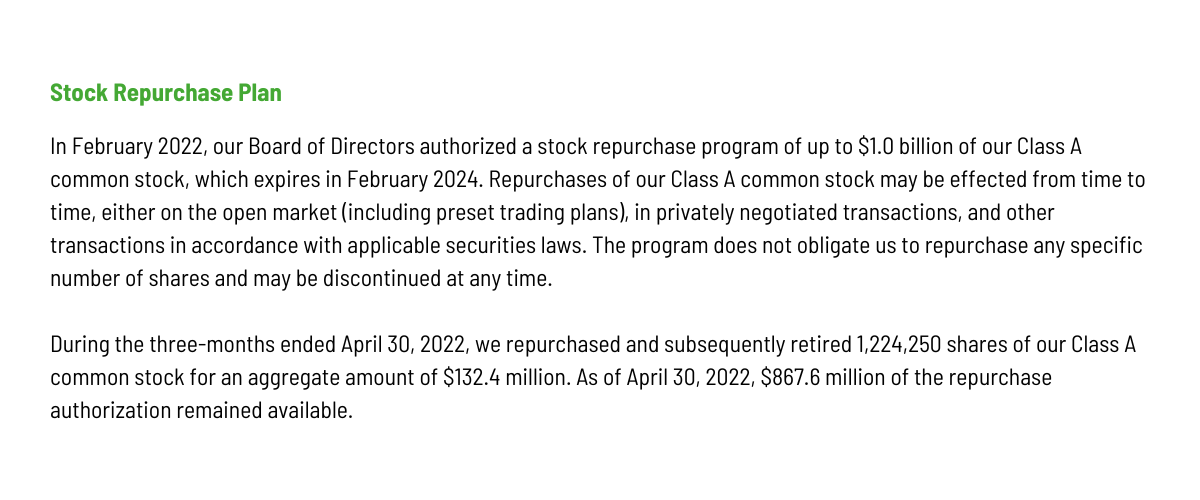

In Q1 of 2022, the Founders portfolio had a new entrant: Zoom(ZM) the cloud based video-communication app at an average buying price of $96. Our buying coincided with management repurchasing and retiring 1,224,250 shares worth $132.4 MM at an average price of $108.15.

Source: Zoom Video Communications 10Q , Q1 2022 Amazon(AMZN) also undertook a share buyback in Q1 2022.

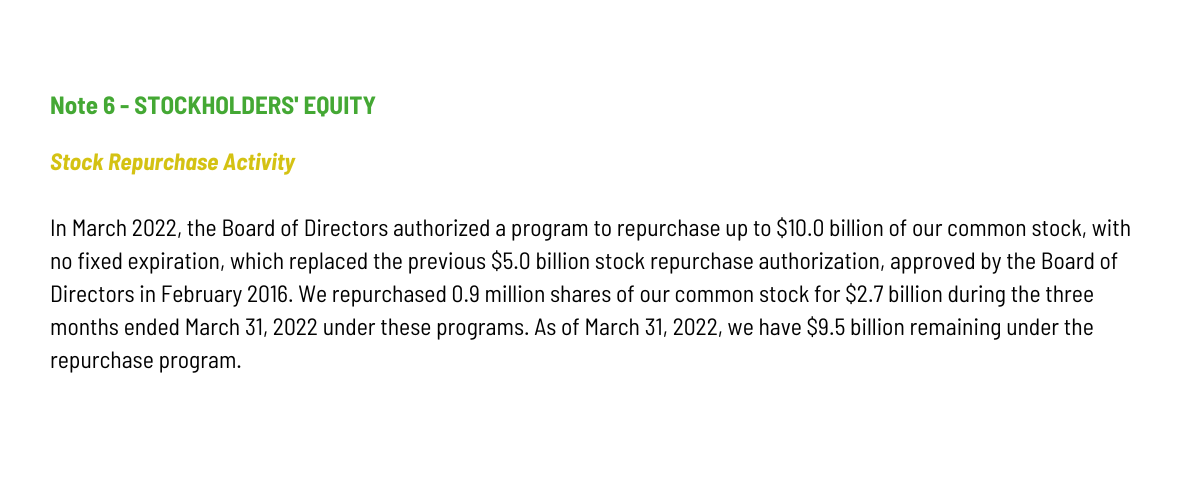

Amazon(AMZN) also undertook a share buyback in Q1 2022. Source: Amazon 10Q , Q1 2022

Source: Amazon 10Q , Q1 2022

Historically the share price of Amazon has displayed significant upside in the periods subsequent to the company buying back shares . The table below illustrates a history of share buybacks by the company and the returns generated for the corresponding 6/12/24 month period when they are undervalued.

Period | Amt Purchased ($MM) | Avg. Price/Share | 6 Month Return | 12 Month Return | 24 Month Return |

Q3:2006 | $252 | $30.69 | 27% | 167% | 158% |

Q1:2007 | $248 | $39.24 | 96% | 84% | 62% |

Q4:2008 | $100 | $45.78 | 39% | 181% | 268% |

Q4:2011 | $277 | $189.22 | 17% | 24% | 93% |

Q1:2012 | $952 | $181.38 | 32% | 45% | 95% |

| Average | $366 | $97.26 | 42% | 100% | 135% |

Source: Company Data, Morgan Stanley Research

Ollie’s Bargain Outlet (OLLI) – another portfolio company whose management felt that their stock was available at a bargain bought back shares worth $200 MM in March of this year. The stock has performed exceedingly well – up 21%* while the S&P 500 is down 20%* for the year so far. A true diversification.

Peter Lynch in his book “One Upon Wall Street” also came up with another iteration of this share buyback: when middle management and directors of the companies are buying their shares it. Quantity is not important but the symbolism of the step has a lot of meaning. What’s the logic?

I am sure you’ll agree that validation from your own family is hardest to get. Every achievement of yours does not seem to meet their heightened expectations unless it gets you a column in the newspaper (in today’s time fame on social media is the equivalent). Likewise, getting your employee to buy more shares of the company is a vote of confidence in the management’s vision which is a feat in itself, simply because the insiders are more aware of the inner workings of the company as opposed to any other investor.

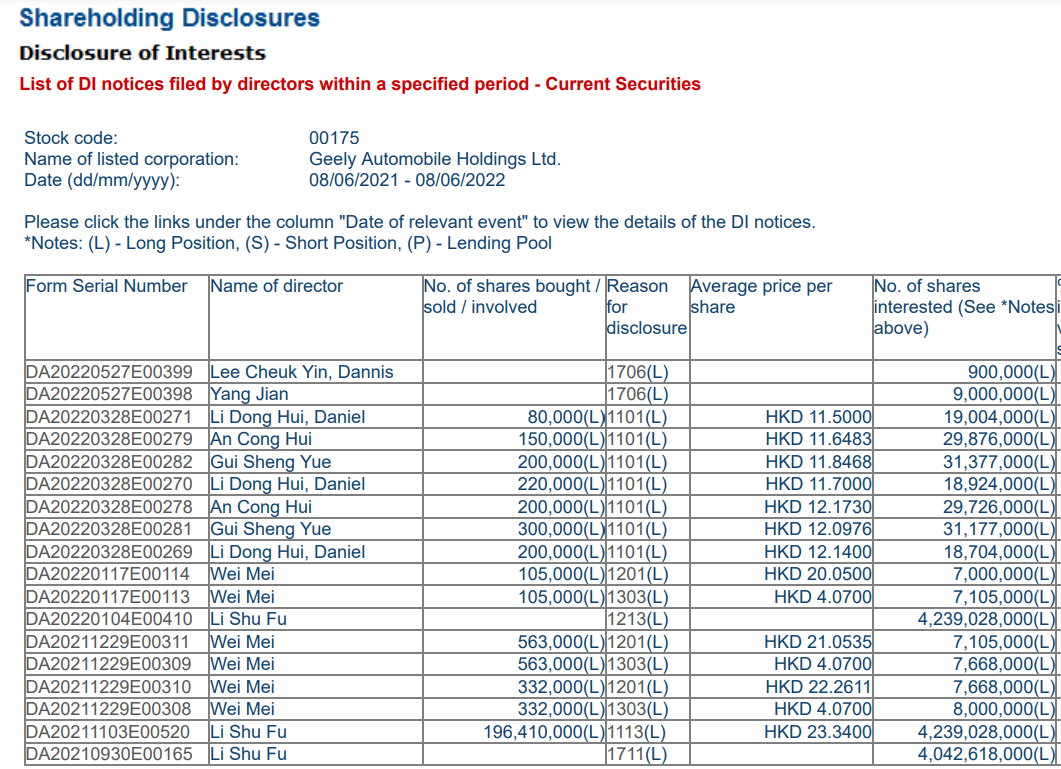

An illustration of the above can be seen in another constituent of Founders Portfolio – Geely (HK.0175) – the Chinese automaker. Below is the english translation of Geely Auto’s recent insider roster. Geely Auto is up from a 52 week low of HK$ 10 as of March 2022 to HK$ 17.9 as of 24th June 2022 a whopping 79% returns vis a vis Hengseng index which is up 19% from its 52 week low.

Source: Hong Kong Exchanges & Clearing Limited

“We haven’t the faintest idea what the stock market is going to do when it opens on Monday,” Buffett said. “We’ve not been good at timing. We’ve been reasonably good at figuring out when we were getting enough for our money.”

Taking inspiration from the Oracle of Omaha, I would urge you all to not stress about wanting to enter the absolute bottom but be approximately right and navigate. After a year or so you will find yourself a lot richer.

The only caveat in buying more of your portfolio stock is you must know what you are holding. I assume you know your stuff.

Happy Investing

Thank you for reading.

Bhuvan Gupta

About the Author Bhuvan Gupta

Bhuvan Gupta

Founder and CEO – CFMC,CFCL

June 29, 2022

Copyright 2023. Client First Capital