Voting Machine or Weighing Machine

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” Benjamin Graham

- The average S&P 500 index returns for all election years is 11.28% (1928 – 2016).

- 19 of the 23 years (83%), S&P 500 gave positive returns.

- When a Republican is elected, the average return is 15.3%.

- When a Democrat is elected, the average return is 7.6%.

Source: Morgan Stanley

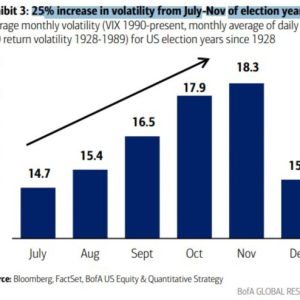

Who will be the next US president is anybody’s guess. Irrespective of the outcome, the above statistics clearly indicate a good year for the markets. As we get into the final overs of the political slugfest, the news cycle will shift its focus to the election debates and away from its earlier preoccupation with inflation and the Fed which has the potential to increase volatility. History does suggest the possibility of increased volatility during H2 of election years.

Volatility is a boon and an opportunity to lap up good quality stocks at attractive valuations.

An important question remains unanswered: As an investor, does devoting time to solve the election/event conundrum add value to the portfolio returns? Some of the more pertinent questions to seek answers for would be:

- Are the companies profitable (Profit 10Y CAGR)?

- Are they run by high-quality learned managers and leaders (10Y Avg RoCE)?

- Does the company carry debt on its balance sheet?

- Does the company have a demonstrable history of delivering returns to its shareholders over the long term?

It might seem an arduous task to find answers to the above questions. But the reward is quite gratifying not just from the monetary sense but also from an intellectual standpoint.

“View the market as a weighing machine, not a voting machine”

Thank you for reading and I hope you liked it.

Your articles never fail to captivate me. Each one is a testament to your expertise and dedication to your craft. Thank you for sharing your wisdom with the world.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?